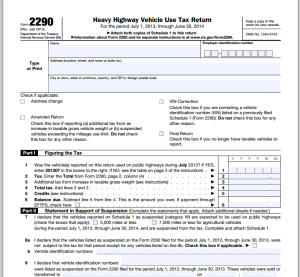

It isn’t unusual to make mistakes on a tax form so don’t feel like you are the only one. The good thing is that there are ways to correct them. Filing an amended tax form is an option that is available to correct a mistake. Their are only three types of corrections that can be made electronically: vin correction, change in vehicle weight, and mileage limit exceeded, however any other type of corrections can be submitted through paper form.

Amendments are the only accepted and legal form of correction made available by the IRS on Form 2290. An electronic or paper amended form is always reviewed and processed by an IRS authority. As with every tax form an amended form is taken very seriously. Any other quick “fixes” to a federal form are highly frowned upon by the IRS to put it simply. It might seem simple and easy to some to make a quick change to a tax form, but that is very illegal.

SO DON’T DO IT!

In 2014, it was reported by LandLinemag.com, that a women in Florida allegedly stole $248,000 from truckers from 2011 to 2014. The U.S. attorney says Jackson would pocket the payment owed to the IRS for the heavy vehicle use tax and distribute fake Stamped Schedule 1 copies. She now faces five counts of wire fraud and one count of possessing a counterfeit IRS stamp.

Possessing a fake IRS stamp has a maximum penalty of five years in jail and up to a $10,000 fine. Just imagine what the rest of the five charges await her might add up to. It is a heavy price to pay for a quick buck. She not only put herself in bad situation but IRS Taxes may still be due for those defrauded truckers. It is very unfortunate they were unknowingly being scammed. This example is just one of many cases where people thought that it was easy to fool the IRS and get away with it.

If you need to make a correction to your Form 2290, call us and we’ll help you do it right!

Written by Yesenia Carrillo