This year the Form 2290 is going through two big changes with the way they collect information for Credits on vehicles that are sold during the tax year. First there is something the seller must do, and second something the buyer must do.

The Seller

If you want to claim a credit for a vehicle you sold, the IRS now wants to know the name and address of the buyer of the vehicle.

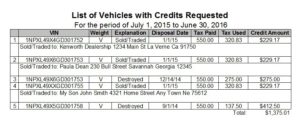

Paper Filing: If you paper file, you need to include a paper statement with your Form 2290. It should include a list of all the vehicles you want to claim credits for, with all of the following points for each unit.

- The VIN

- The Gross Weight as reported on Form 2290

- The date of sale

- The math showing the tax you paid, minus the tax that’s due

- The name and address of the buyer.

The paper you attach could look like this.

e-file:If you e-file all of this information will be transmitted to the IRS digitally, and you don’t need to worry about including a paper statement, or remembering all the required details. e-File will just require the necessary info and include it with the filing. Easy right?

IRS Notices and the Bill of Sale

We’ve talked a lot about IRS notices before so you should already know that most IRS notices are generated by a computer and sent out without being reviewed. This change in the Form 2290 instructions is likely to generate more notices. The best response to this notice will be to send the IRS a copy of the bill of sale. That’s an official document that contains all the information about the date, the vehicle and the buyer and seller. We recommend adding the bill of sale to your file for Form 2290 whenever you claim a credit.

The Buyer

When you buy a truck mid year from a private party (basically anybody who isn’t a dealership) you have to file a Form 2290 for that new-to-you truck. The nice thing is that taxes are prorated. The not nice thing is that there’s now a lot of new stuff you have to do when you file your Form 2290.

First

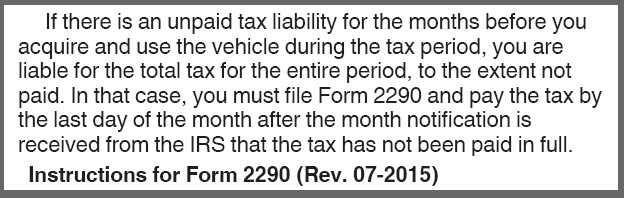

First when you’re buying a truck from a private party you had better make sure they paid their 2290 Taxes. If they didn’t, you could become liable for them. The Form 2290 Instructions recommend asking for a copy of the Stamped Schedule 1 for you to keep in your file along with the bill of sale.

Second

The calculation of your prorated amount of tax is also changing. This is good news – you’re going to pay less tax! Let’s use an example to make this easier. John owns a truck, and he files his 2290 on time in July paying $550. He sells that truck in January to his neighbor Adam. In the old way of doing things, John would collect a refund of $229.17 and Adam would pay prorated taxes of $275.

Let’s do some quick math.

John paid $550 and got a refund of $229.17, meaning the actual tax he paid is $320.83. Now let’s add Adams payment of $275. The actual taxes paid for this truck ($320.83+$275) is $595.83!! That represents an over payment of tax in the amount of $45.83.

So here is what’s changing.

Now when John sells his truck in January, he’ll still get the same refund but Adam will pay $229.17 instead of $275. That way, the taxes paid on each truck, each year will not exceed the amount due for each truck each year.

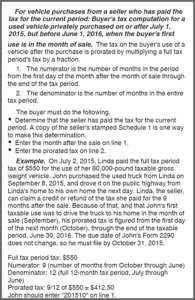

Calculating the Tax

Paper: If you’re filing on paper there is a complex math problem you could do to figure your tax. It involves fractions, and those were never my favorite thing in school. There is a cut out from the instructions to the right, but basically, if you’re going to pay the tax the same month the buyer can claim a refund (because you start using the truck right away) just calculate one month less of tax. Using our example above, Adam will pay tax beginning February instead of January.

e-file: If you file electronically, just use the month FOLLOWING your first use as your “date of first use” and the website will do the proper math for you. Much easier right?

Record Keeping!

Please always keep good records. If you’re going to do anything on a Federal Form, be ready to explain why you did it, and be ready to PROVE it.

Here at 2290Tax, you can always call us if you have questions. We’re here to help make your life easier. Most only do a 2290 once a year, and it’s hard to remember all these crazy details! Just call us any time you have questions. We would love to talk to you.

Writtten by Casey Bullard