At this time there are three amendments available on the online Form 2290. Amending your Heavy Vehicle use tax return means you are correcting a mistake on your stamped Schedule 1. Of the three available amendments, VIN correction is known to be the most common amendment.

How Can I File a Free VIN Correction?

VIN corrections are easy to file and FREE of charge on 2290Tax.com. Don’t hesitate and file your amendment today, simply follow the steps shown below.

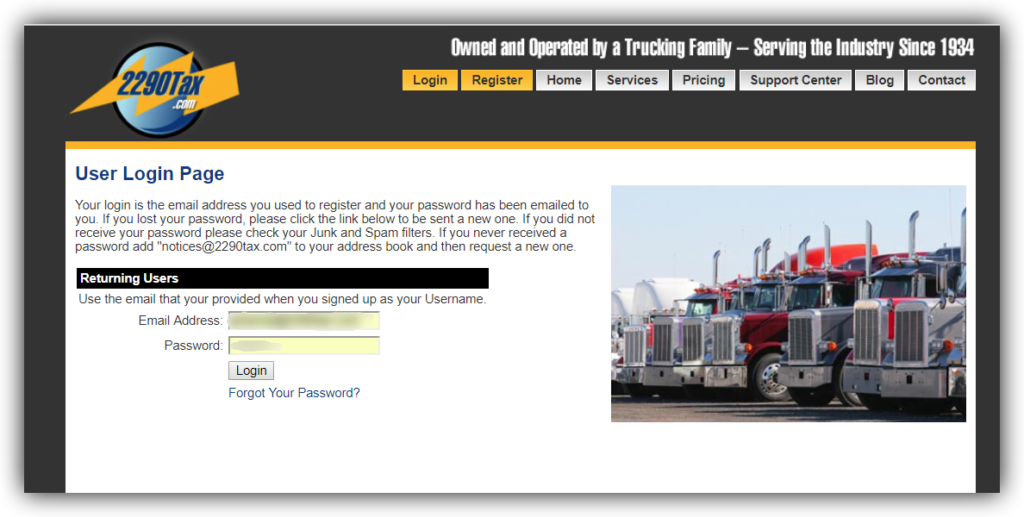

1. Login to your 2290Tax.com account or register if you are a new user.

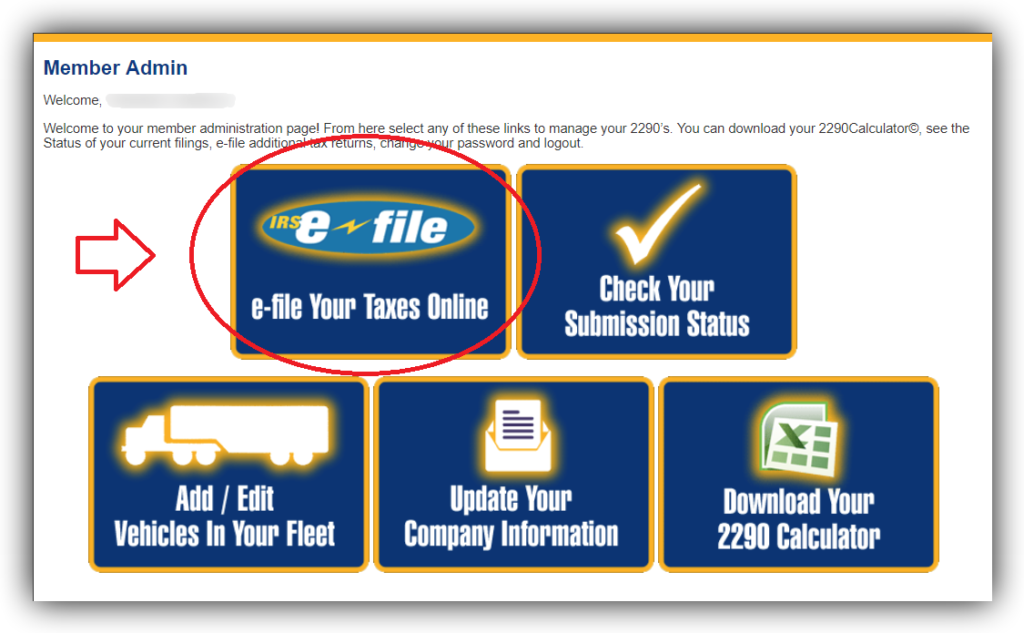

2. Click e-file Your Taxes Online

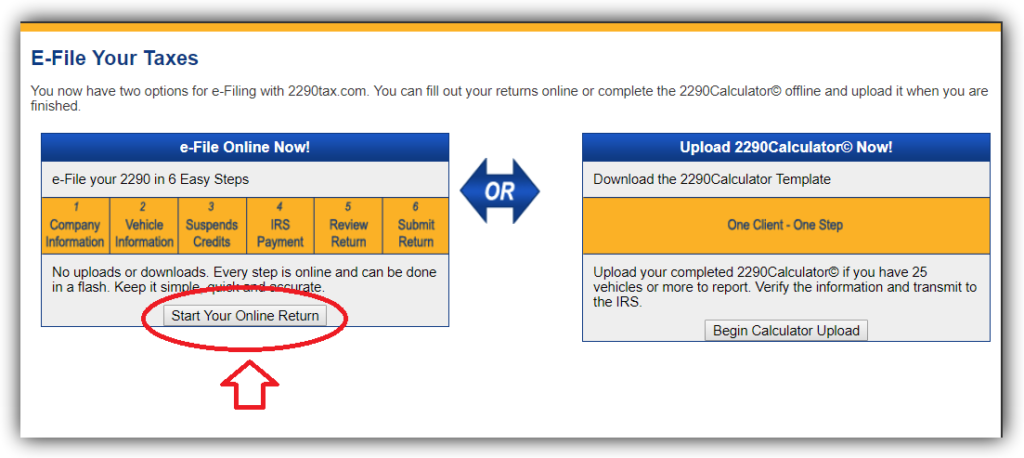

3. Click Start Your Online Return

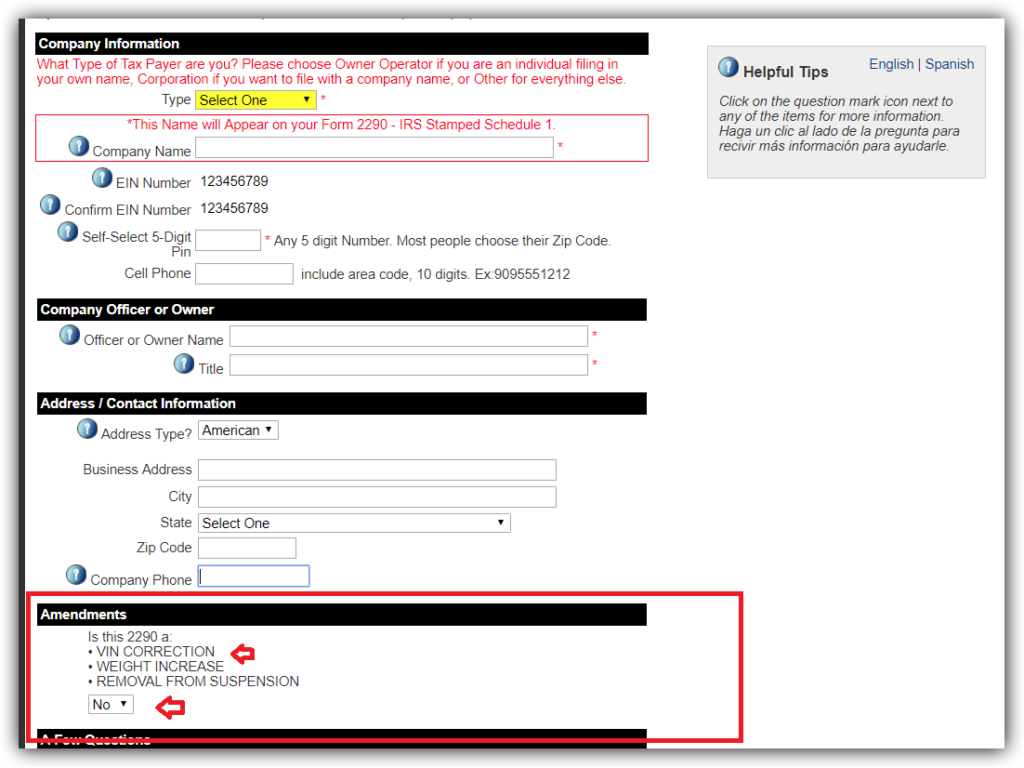

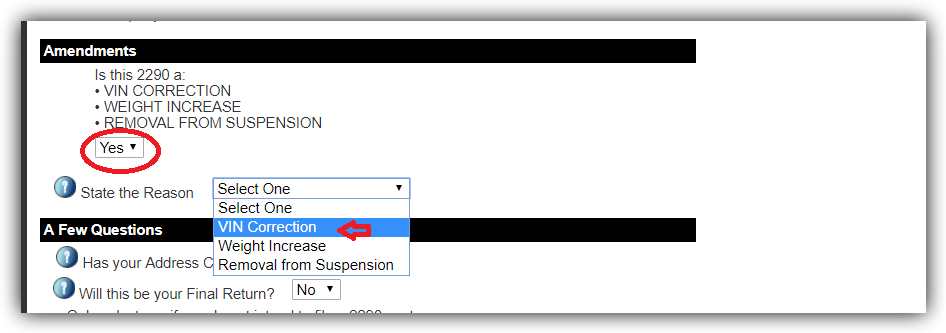

4. Select YES on step 1: Company Information section Amendments

5. Select VIN Correction in section State the Reason

6. Complete steps 1 through 6 to submit your VIN correction to the IRS

*Please Note: iPad, tablet, or mobile Users need to click Desktop Version to file the amendment.

How Long Does The IRS Take To Stamp The Corrected Schedule 1?

Once the amended return is filed it will take the IRS minutes to stamp the corrected Schedule 1. The stamped form will then be emailed to you, completing the VIN correction process.

It is free and easy to file a VIN correction. File today and call us if you need any further assistance.

Watch to learn how to file a Free Form 2290 VIN Correction below:

Stay informed and follow us on Facebook or Twitter!

Written by Yesenia Carrillo