2290Tax.com is introducing it’s newest service: Credit Card 2290 Payment. Taxpayers have an extended flexibility when it comes to paying the HVUT. Follow the steps below to best use the credit card service for Form 2290.

Credit Card 2290 Payment

This feature is only available on the desktop version of the web site. Mobile users (smartphone or tablet devices) will need to click on Desktop Version on the home page (see below).

To begin, start a new return on your account. Steps 1 through 3 are as usual, no changes have been made.

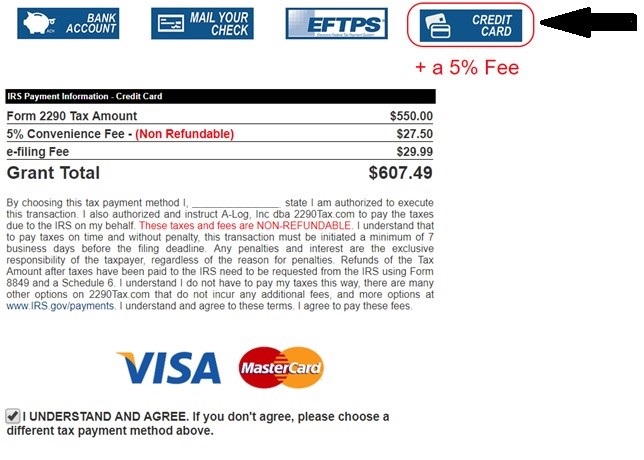

IRS Payment: Credit Card Option

On Step 4 IRS Payment, you will see the option to select Credit Card. There is a 5% Convenience Fee which is Non Refundable. The convenience fee applies to credit card payment only

If you decide you do not want to pay with your credit card, just select one of the other three methods of payment (Bank Account, Mail Your Check or EFTPS). Remember, only credit card payments charges a 5% fee.

Save and continue at the bottom of each step until you get to Step 6 Finish and Pay.

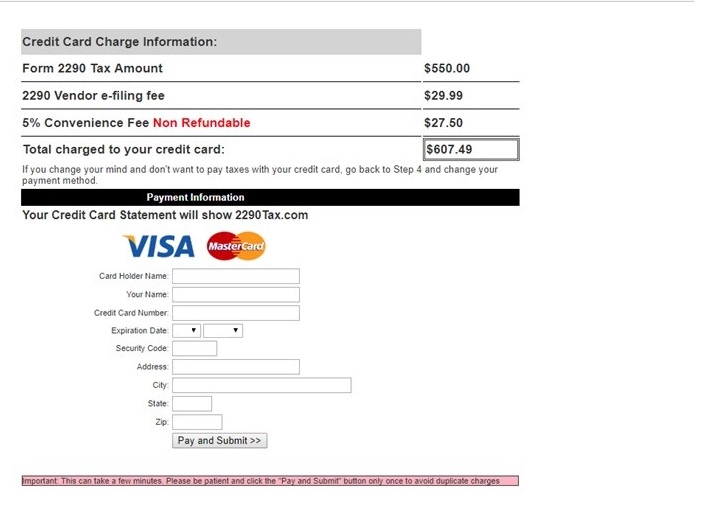

Step 6: Finalize Credit Card Payment

Step 6 is the final step. This is where you will pay with your Visa or Mastercard. When putting in your card number type it in as one long number (no dashes or spaces); type the expiration date, security code and billing address as registered on your card.

When you have all information filled in click on Pay and Submit. Wait a few minutes and you will be prompted to sign documents in HelloSign.

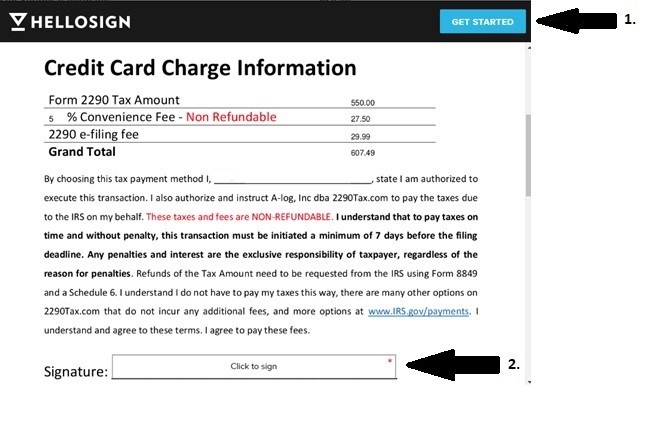

Click on:

- Click on Get Started

- Click in the Click to Sign box

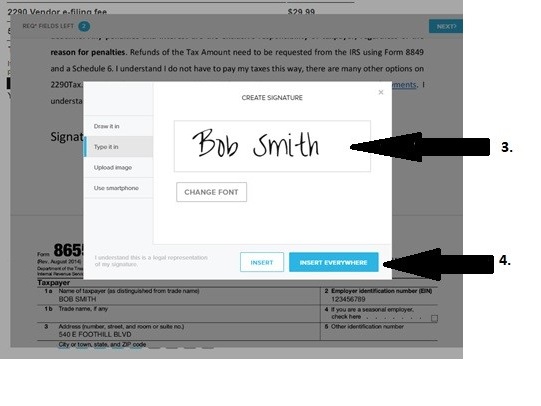

- Click in the Create Signature box and sign your name

- Click Insert Everywhere

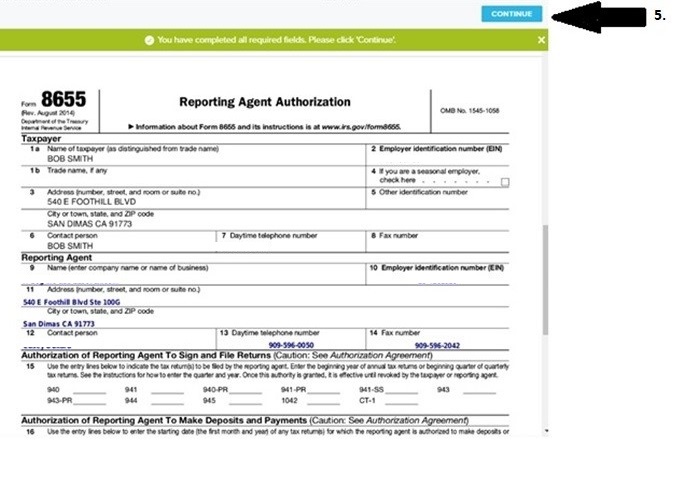

5. Click Continue

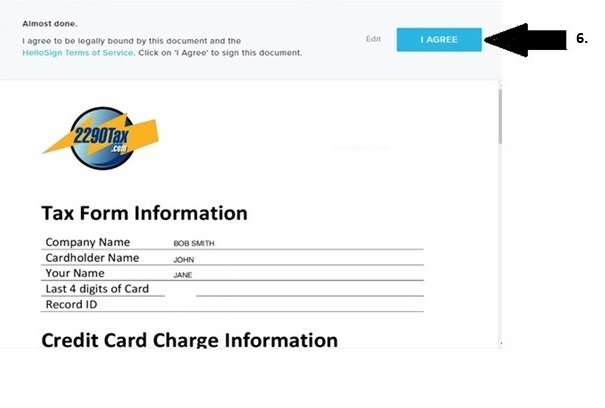

- Click I Agree

This message may pop up for some customers. This is an extra security measure from the issuing bank to verify the transaction is legitimate transaction.

It will either ask you for the last 4 of your social, a password you set up with your bank or a code that is texted to you by the issuing bank. If you have questions about this you will need to call the issuing bank.

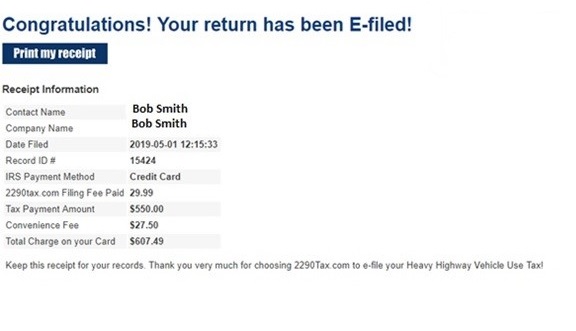

After you complete the steps above you will get the message found below letting you know your 2290 has been submitted to to IRS successfully. Wait 15-20 minutes for the email back from 2290Tax.com with your IRS stamped Schedule 1 for you to print. Your tax payment will be forwarded to the IRS within 3 business days.

E-file just got easier with 2290Tax.com’s newest credit card 2290 payment service. Let us know if you have any questions or concerns, leave a comment below or call us at 909-596-0050. We will be happy to assist you.

Stay connected and follows us on Twitter and Facebook

Written by Jeanie Barrett