The calls have been poring in recently about Form 2290 IRS Penalty Notices – and for good reason. It seems that the IRS issues these notices through a computer program, and if both taxes and the form aren’t received by a specific time on a specific day, that computer program automatically sends a penalty notification. Even if your information was received by the IRS 10 seconds after that computer program ran.

The IRS has issued the following statement:

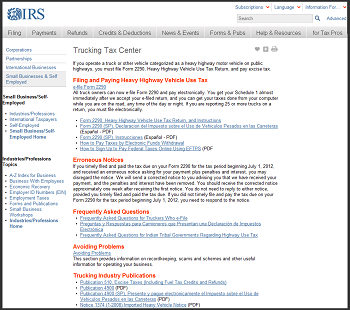

At IRS.gov/Trucker the IRS Said:

“If you timely filed and paid the tax due on your Form 2290 for the tax period beginning July 1, 2012, and received an erroneous notice asking for your payment plus penalties and interest, you may disregard the notice. We will send a corrected notice to you advising you that we have received your payment, and the penalties and interest have been removed. You should receive the corrected notice approximately one week after receiving the first notice. You do not need to reply to either notice, provided you timely filed and paid the tax due. If you did not timely file and pay the tax due on your Form 2290 for the tax period beginning July 1, 2012, you need to respond to the notice.”

You can see it on the IRS page below, and it would be a good idea to add www.IRS.gov/Trucker to your website favorites.

What should you do?

Call the IRS to confirm the receipt of any form 2290 penalty notice you receive if you’re in any way unsure. There is usually a phone number on the notice, but you want to call the IRS 2290 hotline. They are the most qualified when it comes to Tax Form 2290.

Toll Free: 866-699-4096

International: 859-669-5733

Many taxpayers find their Form 2290 IRS penalty notice was sent in error. However, some have some work to do.

You may need to provide proof that taxes were received by the IRS with a copy of the canceled check, or a bank statement. Or you may need to ask that any penalties and interest be waived. Or perhaps payment was never received, and it needs to be sent again.

Only the IRS can tell you exactly what you need because only the IRS has access to your private taxpayer records.

Keep in Touch

Stay up to date with quick tips and IRS news like this by keeping in touch with us here at 2290Tax. There are lots of ways, and you can choose those that fit your needs.

|

|

|