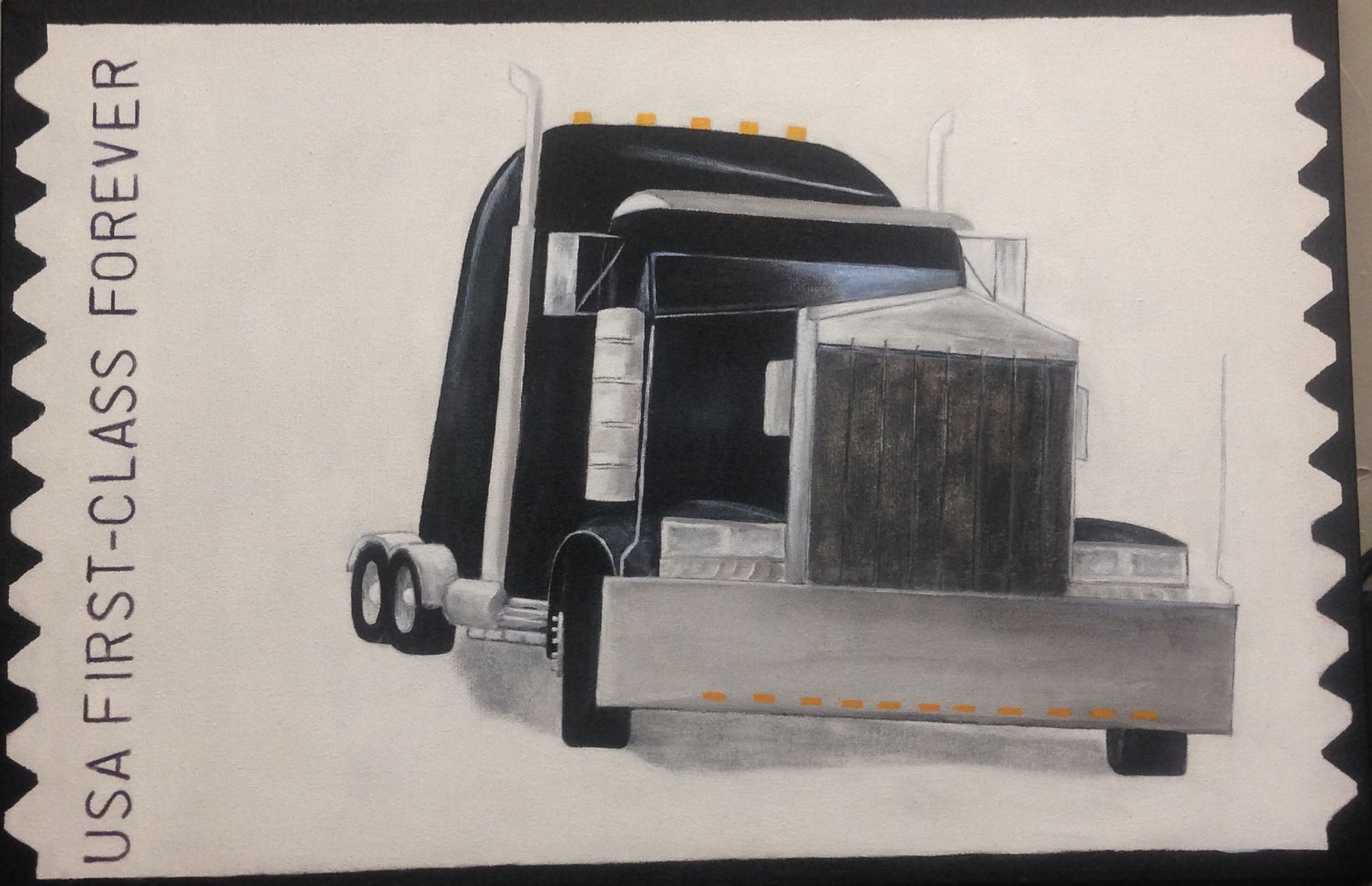

This happened! A friend of 2290Tax.com painted a picture for us when we moved into our new offices on Route66. How he came up with the idea is a whole other story, but it got me to thinking…why haven’t I ever seen a real stamp like that? I’d buy that stamp in bulk and use it for all our mail – if such a stamp existed! The message is right on – Truckers are “First Class Forever” in our eyes.