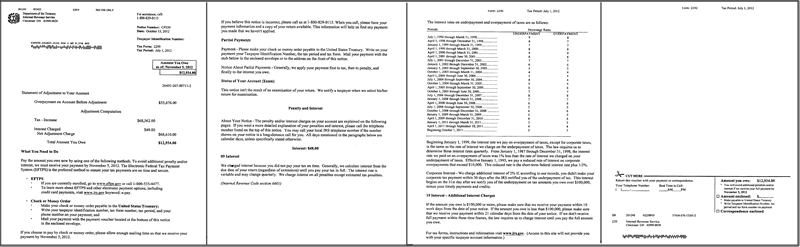

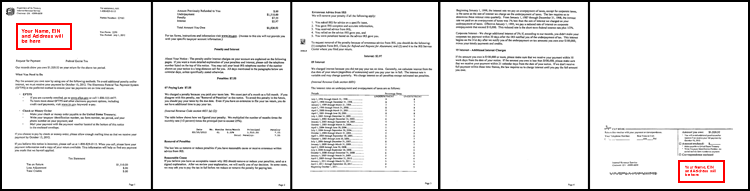

Penalties and Interest are a bummer. Sometimes it’s unavoidable, sometimes it’s not that bad, and some times you can get out of penalties. But it’s always a bummer to get this piece of paper in the mail.

It’s usually a 5 page notice, depending on how many trucks you have, and how complicated the math gets. If you get one of these in the mail, don’t despair! We’re here to help – and the news isn’t always a grim as you might think.

Continue reading “IRS 2290 Notice Decoder – HVUT Penalties and Interest”